Trusted by over 1,000 GST professionals

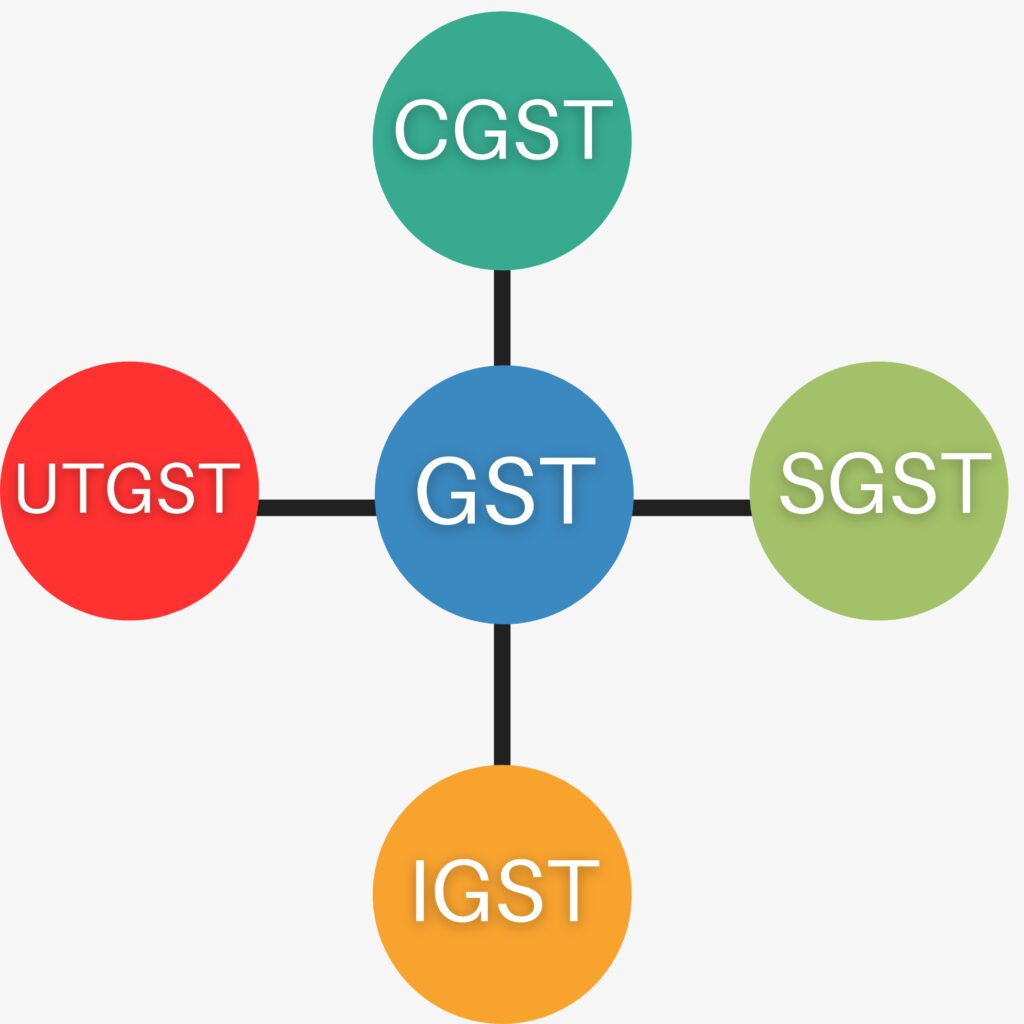

Our GST Course, GST Books and GST Membership – all our GST prodcuts focusses on GST Litigation and dispute resolution. We enhance your drafting skills both in reply of notices and GST Appeals.

Kaushal Kumar Agrawal, takes pride in commitment to excellence and dedication to helping our members succeed in the complex world of GST.

So why wait? Join our community of GST professionals today and take your skills and knowledge to the next level.

Cutting edge, innovative and up-to-date GST Course which covers latest developments in the subject matter.

The future is GST Litigation where disputes are bound to arise. This is one level up GST Practice area both in monetary and knowledge satisfaction area.

K K Agrawal has an experience of + 20 years in both teaching and tax practice. His core area is GST Litigation.

Learn basic to advanced GST from our No. 1 book of GST covering all every aspects of GST Acts, GST Rules, Notifications, Circulars with solutions to many problems faced daily by GST professionals. If you are facing problems in drafting reply to GST notices then we have provided 20 real replies to GST notices.

Where department fails to follow prescribed procedures issued by GST departments then such notices are liable to be quashed by Courts. Learn to challenge the notices on this grounds.

Where there is a disputes in interpretation of GST laws, such as determining eligibility for ITC or applicable tax rates, one can challenge the notices based on their own interpretation of the law. Learn to challenge such notices on legal grounds.

To effectively present your case and establish that there has been no violation of GST laws, it is crucial to provide evidence such as invoices, accounts etc. We shall make you learn in presenting your case / drafting replies based on the merits.

Drafting GST appeals requires a comprehensive understanding of GST laws and a strong command of legal vocabulary to ensure that the appeal is assertive and has the potential to succeed. We can provide you with the necessary knowledge and skills to learn this craft with ease, enabling you to draft effective and persuasive GST appeals.

Our team consists of experienced Advocates and Chartered Accountants, with over 15 years of expertise in GST across all States. We provide a range of well-researched GST resources, both paid and free, that are tailored for GST professionals in the field. Our content is regularly updated and we conduct live sessions on Zoom to keep GST Professionals upto date.

No doubt our focus area is GST Litigation since everyone knows GST compliance.

Our website provides a wealth of resources, including Judgements, bare laws, GST news, GST updates, GST learning lectures etc all carefully crafted by our team of experienced GST professionals in the field. Whether you’re a beginner or a seasoned expert, you’ll find something of value on our website. So, come and discover the latest updates and insights on GST with us today both paid and free!

Kaushal Kumar Agrawal, takes pride in commitment to excellence and dedication to helping our members succeed in the complex world of GST.

Don’t miss our future updates! Get Subscribed Today!

WhatsApp us